Import-export activities are an indispensable part of international trade, helping to connect global supply sources and consumer markets. However, for many businesses, the procedures for importing goods remain a complex process, requiring a clear understanding of legal regulations, documents, and customs processes.

1. Classifying Import Types

This article focuses on the “import for business” category—meaning importing goods from foreign countries into Vietnam for domestic sale or as raw materials for producing domestically consumed goods.

Examples:

- Importing sports equipment or household appliances from China to sell domestically.

- Importing plastic resins from Thailand to manufacture plastic products.

- Importing beef from Japan for distribution in supermarkets.

Special categories such as processing, manufacturing for export, investment, temporary import for re-export, etc., involve more complex procedures and require separate guidance.

2. Checking the Validity of Imported Goods

Before signing a contract, it is necessary to determine:

✅ Are the goods prohibited from import?

✅ Is an import license or quality inspection required, and which authority issues it?

Thorough preparation helps avoid the risk of importing goods that cannot be cleared by customs or are held at the port.

3. Signing the Foreign Trade Contract

When importing goods, businesses need to sign an international Sales Contract, with key terms including:

- Product name, specifications, quantity, price

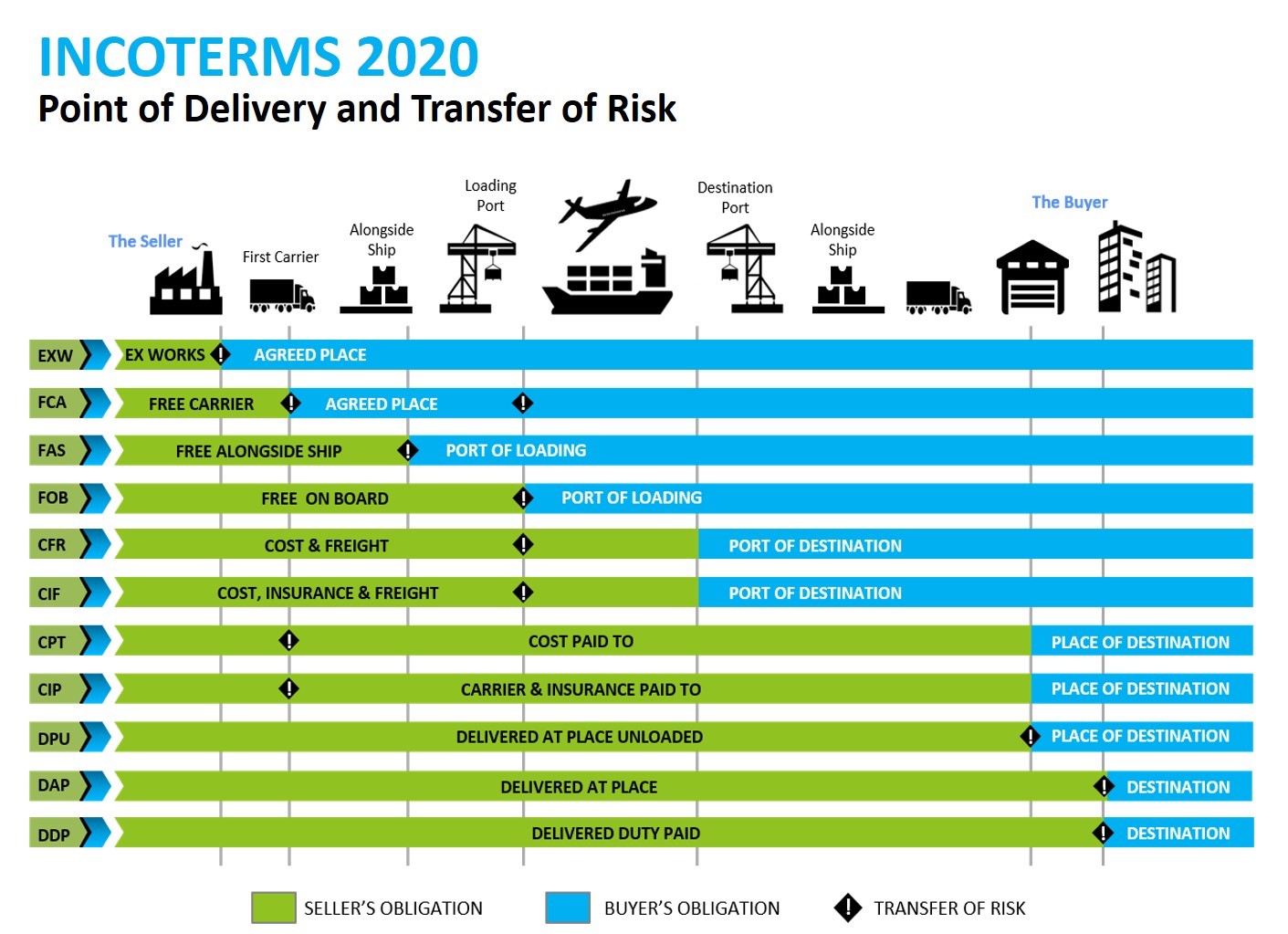

- Delivery terms (FOB, CIF, EXW, DAP…)

- Payment method (T/T or L/C)

- Set of documents the seller must provide (Invoice, Packing List, B/L, C/O…)

4. Transporting the Goods

The responsibilities of the buyer and seller depend on the delivery terms (Incoterms) in the contract.

Examples:

- FOB: The buyer charters the vessel & purchases insurance.

- CIF: The seller bears the cost of transport & insurance to the destination port (e.g., Hai Phong).

- DDP/DAP: The seller bears all costs to deliver to the buyer’s warehouse.

5. Completing Customs Procedures

The importer can either handle the electronic customs declaration themselves or hire a logistics service provider to do so.

The basic set of documents includes:

- Bill of Lading (B/L)

- Commercial Invoice

- Packing List

- Certificate of Origin (C/O)

- Import license, inspection certificate, quarantine certificate… (if any)

The customs declaration is submitted through the VNACCS/VCIS System. Depending on the allocated customs channel (Green – Yellow – Red), clearance time may be fast or may require further document inspection.

6. Receiving Goods and Transporting to the Warehouse

After customs clearance, the business only needs to:

- Obtain the Delivery Order (D/O) from the shipping line or agent.

- Arrange domestic transport (container or truck) to pull the goods from the port or CFS (Container Freight Station) to the business’s warehouse.

Many businesses now opt for full-service logistics packages, which include:

“International Transport – Customs Clearance – Door-to-Door Delivery”

This helps save time, costs, and reduce risks.

7. Conclusion

Import procedures in Vietnam require specialized knowledge and practical experience in handling documentation.

If your business is just starting or does not have a dedicated import-export department, partner with a professional logistics unit for consultation, document preparation, and to ensure customs clearance is fast and compliant.